The Importance of Zakat: Giving Back to Society in Islam

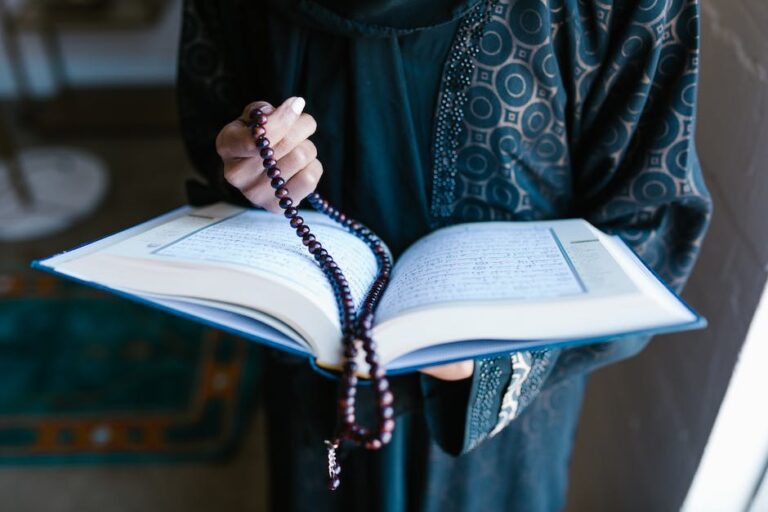

Zakat is one of the five pillars of Islam, which are the foundation of the Muslim faith. It is an obligatory ritual of giving a portion of one’s wealth in order to purify their souls and help those in need. Simply put, it is a form of mandatory charitable giving in the Islamic faith. The act of Zakat is mentioned more than thirty times in the Quran, emphasizing its importance as a religious obligation of Muslims. The word Zakat in Arabic means “to purify” or “to cleanse.”

According to Islam, all wealth and possessions belong to Allah, and humans are only trustees of this wealth. Zakat is viewed as a means of returning what is owed to society and redistributing wealth to ensure that everyone’s basic needs are met.

Purposes of Zakat: Spiritual and Social

The significance of Zakat extends beyond just a social obligation. Paying Zakat not only helps those in need but also offers several spiritual benefits to the believers who practice it. It is considered an act of worship that strengthens one’s faith, demonstrates compassion towards others, and reinforces the social bonds within the community. By giving away part of their wealth, individuals are encouraged to detach themselves from materialistic possessions and become more grateful for what they have.

Zakat also helps to prevent poverty and economic inequality in the society. It is seen as a way to balance out imbalances in wealth and to spread the benefits of economic activity throughout the entire community, rather than just among the wealthy. The practice of Zakat can bring about a sense of social stability and harmony, providing more opportunities for individuals to thrive.

Who is Required to Pay Zakat?

Zakat is not mandatory on every individual but only on those who meet specific criteria. According to Islamic law, Muslims who possess a specific minimum amount of wealth are required to pay Zakat. The minimum requirement is known as Nisab and is calculated based on the value of the net worth of an individual after deducting their debts and liabilities.

The exact value of Nisab varies depending on the current price of silver or gold. Additionally, the type of wealth that is considered taxable under Zakat includes cash, gold, silver, trade goods, and any other income-generating assets.

It is essential to note that Zakat is not only a responsibility towards Allah, but it is also a means of helping the less fortunate members of society. As Muslims, it is our duty to contribute towards building a better society, and Zakat is one way of fulfilling that obligation.

How to Calculate Zakat?

Calculating Zakat can seem overwhelming at first, but it is a relatively straightforward process. The traditional Zakat calculation is 2.5% of the total net worth of an individual’s assets that are held for more than a year. These assets may include cash, gold, silver, jewelry, stocks, rental income, and more. The Nisab value is also calculated to ensure that only those who meet the minimum requirement pay Zakat.

It is essential to calculate Zakat on an annual basis, as it is not a one-time payment. It should be calculated on the same day every year based on a lunar calendar. Additionally, if one’s wealth decreases to the point where they do not meet the Nisab requirement, they do not need to pay Zakat until their wealth meets the minimum threshold again.

Distribution of Zakat in Society

Zakat is distributed among nine categories of people and organizations in the community. These recipients are known as the asnaf, and they include the poor, the needy, the wayfarer, those in debt, those in the path of Allah, slaves who are seeking their freedom, those in service of Islam, and wayfarers who are stranded.

Zakat can be given directly to the needy individuals or through trusted organizations that specialize in Zakat distribution, such as mosques, charities, or welfare organizations. The process of giving Zakat should be done discreetly to avoid any embarrassment for the recipient and should be given with an intention of purifying oneself and seeking Allah’s blessings.

The distribution of Zakat in Islam is an integral part of Islamic society, as it ensures that the wealth is distributed fairly among the less fortunate members of society. The practice of Zakat cultivates a sense of compassion, empathy, and generosity among Muslims and helps to build a more equitable and just society.

Benefits of Giving Zakat for Individuals and Society

Giving Zakat can have several benefits for both individuals and society as a whole. On a personal level, it enables individuals to cultivate a sense of empathy and compassion towards those in need. It also facilitates detachment from material wealth and excites the spirit of sacrifice, which ultimately leads to spiritual satisfaction and inner peace.

By paying Zakat, the giver becomes a means of fulfilling the basic needs of the less fortunate members of society, which, in turn, helps build a more stable and cohesive society. It can also help to prevent the wealth gap and increase social mobility and financial inclusion, leading to long-term economic growth and prosperity.

Moreover, Zakat enables Muslims to demonstrate their commitment as responsible members of society by giving back to those who have been lesser blessed with wealth or means of generating income. By contributing to the welfare of the community, individuals also earn the respect and appreciation of society as a whole.

Conclusion: Importance of Zakat for Muslim Community

Zakat is not just an act of charitable giving, but it is a fundamental obligation of the Muslim faith that has significant spiritual and social implications. It is an act of worship that strengthens individual faith, demonstrates compassion towards others, and reinforces social bonds within the community.

Furthermore, Zakat helps build a more equitable society by balancing out imbalances in wealth and preventing poverty. It also reinforces the importance of social responsibility and encourages a culture of generosity and giving back, which ultimately leads to a more stable and prosperous society.

In the end, Zakat is a powerful tool that can transform individuals and society alike. By paying Zakat, Muslims contribute to building a better world, fulfilling their religious duty, and earning the blessings and rewards of Allah.